The continuation patterns usually indicate that the sideways price action on the chart is nothing more than a pause in the prevailing trend.

Usually after the breakout the price movement will be in the same direction as was the prevailing trend.

Sometimes is possible if be formed at the end of the trend to act as reversal patterns.

Key Characteristics of Continuation Patterns

All the continuation patterns be formed have the same characteristics:

Prevailing trend

The price is moving in uptrend or downtrend but has lost the momentum.

Consolidation zone

A constrained area defined by a set of 2 – 3 bottoms and highs as support and resistance levels.

Breakout point

The point at which the price breaks out of the consolidation zone and it is between two-thirds to three –quarters of the consolidation zone.

New trend

Usually a resumption of the old trend that the price enters as it comes out of the consolidation zone.

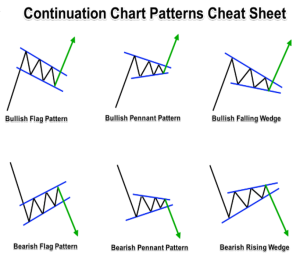

The most common continuation patterns

Triangles

Pennants

Flags

Wedges

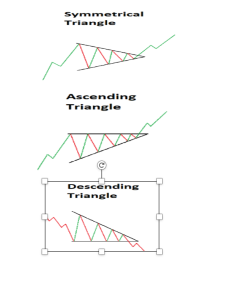

Triangles Continuation Patterns Analysis

There are three types of triangles:

Symmetrical triangle shows two converging trendlines, the upper line descending and the lower line ascending.

Ascending triangle has a rising lower line with a flat or horizontal upper line.

Descending triangle has a falling upper line with a flat or horizontal lower line.

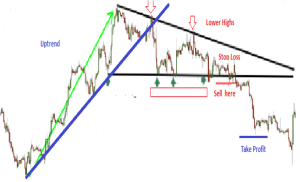

How to trade the Symmetrical Triangle Continuation Patterns

The price should breakout in the direction of the prior trend somewhere between two-thirds to three-quarters of the horizontal width of the triangle.

The new price target measuring the breakout is to measure the height of the vertical line at the widest part of the base and measure that distance from the breakout point.

A second method is to draw a trendline from the top to the bottom parallel to the lower trendline.

Stop loss above the highest top of the triangle and take profit target equal the widest part of the triangle.

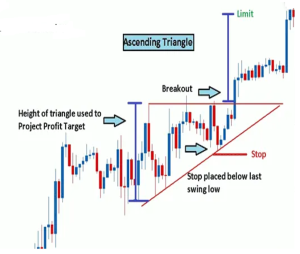

Trading the Ascending Triangle

The upper line is flat with highs at the same level while the lower line is rising following higher bottoms.

It is a sign that the buyers are more aggressive than the sellers.

Measuring technique for the take profit after the breakout is similar with symmetrical triangle.

If this formation occurs at the end of a downtrend it is a bullish signal and act as reversal pattern.

Bearish Descending Triangle

It is a mirror image of the ascending triangle and is generally a bearish pattern.

It indicates that the sellers are more aggressive than the buyers.

The sell entry signal occurs after a decisive close under the lower trendline.

Take profit will be equal with the height of the triangle and the stop loss will be placed 5 pips above the last lower high before the breakout.

Variation of Ascending Triangle as Reversal

It is not unusual at the end of a downtrend to see a ascending triangle pattern.

An ascending triangle at the bottom of a downtrend is a bullish reversal pattern.

The breaking above the upper line signals completion of the base and is considered a bullish signal.

Take profit will be equal with the height of the triangle.

Stop loss 5 pips below the last higher bottom before the breakout

Reversal Descending Triangle in uptrend

The descending triangle at the top of an uptrend is a bearish reversal pattern.

The lower highs of the top shows that the buyers has lost their momentum.

A close of the price below of the bottom line is a trend reversal signal.

Take profit will be equal with the height of the triangle.

Stop loss will be placed a few pips above the last lower high.

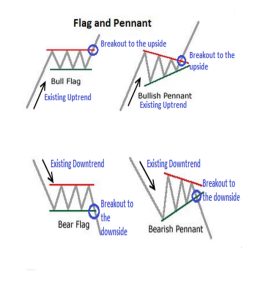

Flags and Pennants Formation

The flag and pennant formation are quite common. They are very similar and represent a brief pauses in the existing trend.

One of the requirements for both is that they preceded by a sharp and almost straight line move.

After a steep advance or decline of the trend, the flag and pennants are briefly pauses to catch the breath.

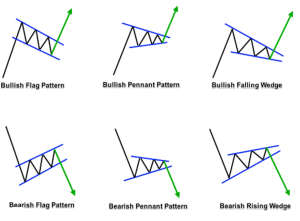

Key Characteristics of Flag Patterns

Formation: A flag resembles a small rectangle or parallelogram that forms during a brief consolidation after a strong price movement. It typically slopes against the prevailing trend.

Trend Direction: Appears after a sharp upward or downward price move, known as the “flagpole.”

Bullish Flag: Forms in an uptrend, where the flag slopes downward.

Bearish Flag: Forms in a downtrend, where the flag slopes upward.

Volume: The initial price movement is accompanied by high volume, while the consolidation phase typically sees a volume decline. Volume spikes again on the breakout.

Breakout: The pattern is confirmed when the price breaks out of the flag in the direction of the prevailing trend (upward in a bullish flag, downward in a bearish flag).

Target Price: The target is typically equal to the height of the flagpole projected from the breakout point.

Key Characteristics of Pennant Patterns

Formation: Pennants are small, symmetrical triangles formed by converging trendlines during a consolidation phase after a strong price movement.

Trend Direction: Like flags, pennants occur after a strong directional move (the flagpole) and signal a continuation of the trend.

Bullish Pennant: Forms after a strong uptrend, with price consolidating in a tight range before breaking upwards.

Bearish Pennant: Forms after a sharp downtrend, with price consolidating in a small triangle before breaking downwards.

Volume: Similar to flags, pennants experience decreasing volume during consolidation and increased volume during the breakout.

Breakout: The pattern is validated when price breaks out of the triangle in the direction of the prevailing trend.

Target Price: The projected price movement after the breakout is typically equal to the length of the flagpole.

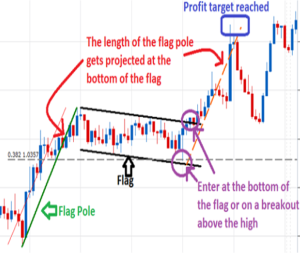

Flag Continuation Pattern in Uptrend

The flag resembles a parallelogram or rectangle marked by two parallel trendlines that tend to slope against the prevailing trend.

In an uptrend the flag would have a slight downward slope and vice versa.

The flag usually occurs near the midpoint of the movement and after the breakout, the price will continues moving in the direction of the trend.

Trading Strategy

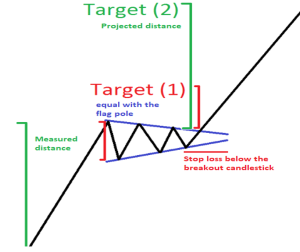

Flags and Pennants are said to “fly at half-mast” from a flagpole.

The flagpole is the prior sharp advance or decline movement.

The term “half-mast” means that the flag appears at about the halfway point of the move.

The equal vertical distance of the preceding move is measured from the breakout point of the flag if the upper line broken.

Trading the Flag in a downtrend

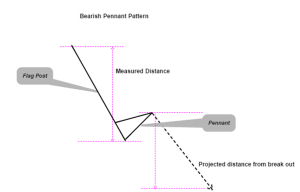

Trading the Pennant Patterns

The pennant patterns are similar to flags, with the main difference being that the patterns are formed as converging trend lines into a triangle.

The bullish and bearish pennant chart patterns work on the same principles of the flag patterns.

The chart shows the measure distance and the projected distance after a bearish breakout.

After a sharply downtrend movement the price consolidates as a brief pause of the trend

The bearish pennant pattern is identified by converging trend lines forming a pennant that is sloping upwards at the bottom end.

It is somewhat similar to a symmetrical triangle formed within a smaller number of candles, but preceded by a sharp bearish drop.

Measuring technique and Take profit targets

After the break out of the consolidate area the first take profit is the equal distance with the flag pole.

The second target is the projected distance after the breakout equal with the measured distance.

The stop loss initial will be below the candlestick of the breakout but will be modified following the price movement.

Trading the Pennant Pattern in and uptrend

Common Mistakes to Avoid

Entering too Early: Wait for confirmation of the breakout before entering.

Ignoring Volume: Lack of volume during the breakout can lead to false signals.

Misidentifying Patterns: Ensure you correctly identify continuation patterns, as misinterpretation can lead to losses.

Failing to Manage Risk: Always place a stop loss, as patterns can fail.